Garbage? To David Steiner, it's "all good."

Garbage? To David Steiner, it's "all good."

(Fortune)

There's more than a shred of truth to the phrase "one man's trash is another man's treasure." In this instance, the other man is Waste Management CEO David Steiner, whose company turns waste of all kinds into renewable energy and valuable recycled commodities. Waste Management operated 269 active landfills and 114 recycling facilities in 2012. It processes more than 12 million tons of recyclable materials alone. Fortune's Adam Lashinsky interviewed Steiner, who has been the CEO for nine years, to discuss the challenges of recycling, China's environmental footprint, renewable energy, and the future of garbage. A lightly edited transcript follows.

Fortune: Just to get things started, if you could give an overview of the company: Where are you, how big are you, who are you?David Steiner: Yeah. So we do basic solid waste services throughout the United States and Canada. So when I say basic solid waste services, we're talking about recycling, we're talking about waste-to-energy, and then we're talking about all sorts of different types of collection and disposal for -- all the way from your household to big businesses to small businesses. We're covering them all, about 22 million customers throughout the United States and Canada.

And then about five years ago we went into waste-to-energy internationally. So what you've got is China has two problems: not enough electricity and a lot of garbage. What's the best solution? Burn the garbage to create electricity. So we have a joint venture in China where we're building waste-to-energy plants. And then we've got another joint venture in -- predominantly in England, but throughout Europe where we're building waste-to-energy plants.

So when you look at it, we're about 10% of our business is recycling, about 10% of it is waste-to-energy. Those two are growing faster than anything else we do in our business. We're seeing growth rates on recycling in our business at about 15 to 20% a year. We'll see that same kind of growth rate in waste-to-energy.

Nnmadi E. Armsrtong

23408162319833, 23408122735908

stone4sloane@gmail.com

Major

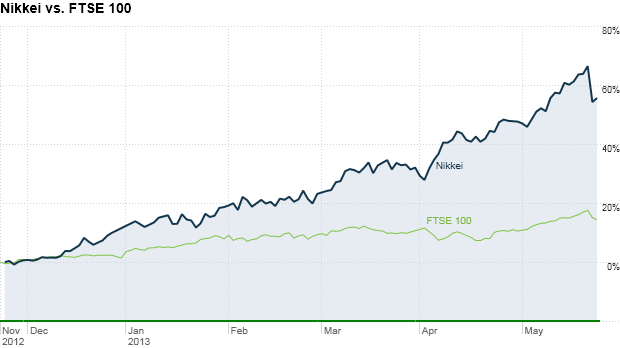

European indexes, including London's FTSE 100, have made significant

gains over the past few months but have not pushed nearly as high as

Japan's Nikkei or U.S. benchmarks.

Major

European indexes, including London's FTSE 100, have made significant

gains over the past few months but have not pushed nearly as high as

Japan's Nikkei or U.S. benchmarks.