May 20 (Reuters) - The following bids, mergers, acquisitions

and disposals were reported by 2000 GMT on Monday:

** Yahoo Inc will buy blogging service Tumblr for

$1.1 billion cash, giving the Internet pioneer a much-needed

social media platform to reach a younger generation of users and

breathe new life into its ailing brand.

** Tom Wheeler, nominated to become the new chairman of the

Federal Communications Commission, pledged to divest stakes in

AT&T Inc, Dish Network Corp, Google Inc

and dozens of other tech and telecoms companies if he is

confirmed.

** Softbank Corp is seeking to raise about 400 billion yen

($3.90 billion) through a sale of retail bonds to

finance its bid for No.3 U.S. mobile phone carrier Sprint Nextel Corp, the Nikkei reported.

** The largest U.S. satellite video provider, DirecTV

, is one of the companies considering a bid for online

video website Hulu, according to a source familiar with the

situation.

** After months of speculation, Vodafone's Vittorio

Colao will be under pressure next week to set out whether he may

sell its prized stake in Verizon Wireless in what would be one

of the biggest deals ever.

** Greece's bank rescue fund will aim to sell Hellenic

Postbank and Proton by mid-July with big banks continuing to

absorb small lenders as part of plans to revive the battered

sector, the country's foreign lenders said in an inspection

review.

** Sudan, struggling with economic crisis and a budget

deficit, plans to sell stakes in four state-owned sugar plants

to attract partners, the official news agency SUNA said.

** New Zealand casino operator SkyCity Entertainment Group

has bought Wharf Casino in the resort town of

Queenstown for NZ$5 million

($4.04 million) as the company aims

to expand its presence in the area, a growing tourist

destination.

**

France's Danone is aiming for a bigger slice of one of the world's

fastest-growing dairy markets by investing 325 million euros

($417

million) in two deals with

China Mengniu Dairy Co Ltd.

** Dutch specialist publisher Wolters Kluwer said

on Monday it has acquired Brazil's Prosoft Tecnologia, a leading

provider of tax and accounting software with 250 employees.

** Royalty Pharma raised its hostile bid for Elan

to

$12.50 per share and heaped pressure on shareholders,

saying it will withdraw the bid if they approve a series of

defensive transactions announced by the Irish drug

firm

** Morgan Stanley said on Monday it has signed an

agreement to sell its Indian wealth management unit to Standard

Chartered. Financial terms of the deal were not

disclosed.

** Standard Chartered has agreed to buy the Indian

wealth management unit of Morgan Stanley, helping the

British bank expand its private banking business in Asia's

third-largest economy.

** Billionaire American industrialist Leonard Blavatnik may

buy a stake in Russian mobile phone retailer Svyaznoy for

$200

million, Russia's business daily Vedomosti reported on Monday,

citing a source close to one of the retailer's shareholders.

** Goldman Sachs Group Inc launched the sale of about

$1.1 billion worth of Hong Kong-traded shares in Industrial and

Commercial Bank of China 1398.HK on Monday, offering its entire

remaining stake in the world's biggest bank by market

value.

** U.S. investment management firm Tradewinds Global

Investors cut its stake in Italian state-controlled defence

group Finmeccanica to 1.85 percent last week from 4.98

percent it held since May 2012, Italian market regulator Consob

said on Monday.

** Miner Kazakhmys, a top shareholder in ENRC

, said it would consider a potential cash-and-share

buyout bid for its rival, giving its first response to a

potential offer from ENRC's trio of founders first signaled last

month.

** Britain's Vodafone has withdrawn from the running

to provide a mobile service to fixed-line operator BT,

two industry sources told Reuters, bringing to an end a

nine-year partnership.

** Russian state-controlled telecoms operator Rostelecom

may sell more than

$500 million worth of treasury

shares to reduce debt, its newly appointed chief executive

Sergei Kalugin said on Monday.

** Italian motorway operator Atlantia said on

Monday no deal had been reached over a sale of its towers

transmission business Towerco.

** Generic drugmaker Actavis Inc, itself a recent

takeover target, said on Monday it would buy specialty

pharmaceutical company Warner Chilcott Plc for

$5

billion in stock to expand its branded drug portfolio, lower

taxes and increase profits.

** Dell Inc said in a letter to suitors Carl Icahn

and Southeastern Asset Management that the company would not

provide more information about itself unless the board

determined that their proposal was "superior" to founder Michael

Dell's.

** Plains Exploration & Production Co shareholders

approved the oil company's takeover by mining company

Freeport-McMoRan Copper & Gold Inc FCX.N, after both companies

sweetened the more than $6 billion deal with two special

dividends.

** Pactera Technology International Ltd said on

Monday that Blackstone Group LP, together with the

company's management, made a

$680.3 million non-binding proposal

to take China's largest technology outsourcing firm

private.

** Websense Inc said it had agreed to be taken

private by Vista Equity Partners in a deal that values the

online security firm at about

$907 million, a move that should

come as a relief to investors after years of weak sales from its

legacy business.

** GrubHub and Seamless, which

allow consumers to easily order online from various restaurants,

said they are merging in a deal that they hope will drive more

orders, in more cities, through their platforms.

** The privatisation of five UK prisons has been delayed by

the Ministry of Justice following an investigation into whether

it was overcharged on two contracts with private-sector

companies, the Financial Times reported.

Garbage? To David Steiner, it's "all good."

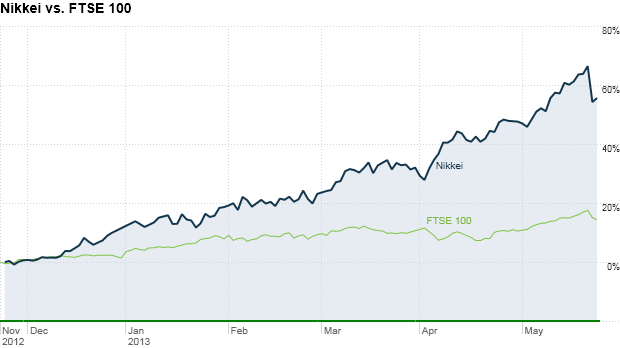

Garbage? To David Steiner, it's "all good." Major

European indexes, including London's FTSE 100, have made significant

gains over the past few months but have not pushed nearly as high as

Japan's Nikkei or U.S. benchmarks.

Major

European indexes, including London's FTSE 100, have made significant

gains over the past few months but have not pushed nearly as high as

Japan's Nikkei or U.S. benchmarks.