1

Corporate Social Responsibility: The New Socialism

Andrew Markley, J.D., M.P.I.A.

Businesses face significant challenges in their quest for success today: The ongoing

effects of the financial crisis, the Eur ozone crisis, and uncertainty regarding new regulatory

initiatives in the areas of healthcare, labor union policy and financial regulation are among the

most prominent issues facing companies. As important as these issues are to both the short- and

long-term viability of companies,a greater threat to private enterprise—and our very economic

system—can be found in the current version of demands for “corporate social responsibility”

(CSR).

1

While most companies are, of necessity, devoting the time and resources to develop an

understanding of the threats posed by events such as the financial crisis and by government

regulatory expansion, it is not clear that companies understand either the context or the content

of the contemporary movement demanding CSR.The CSR movement, however, is quickly

moving in a direction which would fundamentally undermine private enterprise by redefining the

very nature and purpose of business. CSR—could this be the model, while ostensibly

recognizing the existence of firms within a market economy, which undermines firms and

markets and ushers in an age of socialism?

The Contemporary View of CSR

To focus our attention on the fundamental shift demanded by contemporary CSR

advocates, it is important at the outset to contrast the view of business advocated by the

contemporary CSR movement with the more traditional view of business. The outline of what

the current CSR movement demands has become clearer in recent years, both as CSR advocates

1

Corporate Responsibility, Social Responsibility, and Corporate Citizenship all can be used as variants of the term

CSR. For a more complete discussion, see Michael Kerr, Richard Janda and Chip Pitts, Corporate Social

Responsibility: A Legal Analysis(Canada: LexisNexis Canada, 2009), 22-25.

2

have had the opportunity to write on the subject and as international organizations have produced

written statements of CSR principles.

The Traditional View of the Role of Business

The traditional U.S. view of the role of business in society can be described as follows:

(For emphasis, I have italicized the description both here and in the paragraph below.) A business

succeeds when it meets the demands of the marketplace and provides an acceptable return to the

firm’s owners. In conducting business, the firm should observe ethical standards—such as

honesty—and should abide by the law. In many countries, laws establish a significant body of

government regulation on topics such as employment, environment, antitrust, labor union, and

consumer protection. In order to maximize the firm’s opportunities for success in the

marketplace, the firm must not only satisfy its customers, but also fulfill the terms of its

commitments to suppliers and lenders, and provide conditions and incentives for its workforce to

be productive. In pursuing success in the marketplace, however, the firm’s management is

always obligated to act in the long-term best interests of its owners. In achieving success, the

business benefits not only its customers and its employees but also the communities in which it

operates.

The Contemporary CSR Movement’s View of the Role of Business

Now contrast the traditional view described above with that of the contemporary CSR

movement, which is the model adopted in recently adopted CSR standards and is increasingly

taught in business schools. While a business succeeds by meeting the demands of the

marketplace, that success is dependent upon a societal framework which includes consumers

who are ready to buy the firm’s product or service,infrastructure which the firm uses to conduct

its business, educated employees who engage in productive work for the firm, and a natural

3

environment conducive to company operations. The firm’s ongoing goal and the obligation of

management in particular, beyond what is mandated by ethics and the law, is to earn and keep

the firm’s social license to operate by meeting society’s expectations for the firm’s “triple-bottom-line” obligations to

• stakeholders of the firm, including employees, suppliers, creditors, the surrounding

community, and anyone else affected by the firm’s existence;

• the natural environment; and

• economic development.

The triple bottom line ultimately ensures that business contributes to sustainable development.

While achieving the triple bottom line is currently left to business strategy, government must

soon mandate the triple bottom line because notall companies will voluntarily comply.

2

Recent initiatives on the international level which delineate CSR principles reflect this

view of CSR. In November 2010, the International Organization for Standardization (ISO)

published the ISO 26000 “Guidance Standard on Social Responsibility” after a multi-year effort

bringing together representatives from 99 countries and more than 40 international

organizations.

3

According to Rob Steele, ISO Secretary-General, ISO 26000 is a triple-bottom-line standard. He states, “In short, it is no longer just the financial ‘bottom-line’ that people

measure an organization on anymore. It is the impact the organization has on the environment

and on society as well as on the economy.”

4

ISO 26000 defines “social responsibility” as

behavior that not only observes ethical standards and complies with applicable law, but also

“takes into account the expectations of stakeholders” and “contributes to sustainable

2.The term “triple bottom line” is attributed to John Elkington. See John Elkington, Cannibals with Forks: The

Triple Bottom Line of 21

st

Century Business(Oxford: Capstone, 1997).

3.“Social Responsibility: Dawn of a New Era,” ISO Focus Plus(March 2011): 1.

4.Rob Steele, “ISO Responds: We Are All Responsible for Our Actions,” ISO Focus Plus(March 2011): 9.

4. development, including the health and welfare of society.”

The term “stakeholder” is defined

broadly—as an “individual or group that has an interest in any decision or activity of an

organization”—and ISO 26000 goes to great lengths to define obligations to particular

stakeholders, including employees, customers, suppliers and the community. For example, ISO

26000’s section on “Community Involvement and Development” includes a separate focus on

each of the following topics: Community Involvement, Education and Culture, Employment

Creation and Skills Development, Wealth and Income Creation, Health and Social Investment.

For each of these topics, the subsection contains a list of “Related Actions and Expectations.”

6.The same detailed treatment is afforded to all of the stakeholder groups identified in the ISO

26000 standard.

ISO 26000 defines “sustainable development” as“integrating the goals of high quality of

life, health and prosperity with social justice and maintaining the earth’s capability to support life

in all its diversity.”

7.As in the case of stakeholders, the text of ISO 26000 goes to great lengths to

define principles regarding environmental issues ranging from climate change to species

protection, and prescribing environmental practices from the preparation of environmental

impact statements to adopting the precautionary principle.

8. The “triple-bottom-line” mandate is

clearly reflected in ISO 26000, especially with its focus on environmental and stakeholder issues,

and its detailed listing of principles on each topic.

5

International Organization for Standardization, ISO 26000 Final Draft International Standard, Guidance on Social

Responsibility, Sub-clause 2.18 (Geneva,Switzerland: ISO, 2010).

6

ISO 26000 Final Draft International Standard, Sub-clauses 2.20, 6.4, 6.6, 6.7 and 6.8.

7

ISO 26000 Final Draft International Standard, Sub-clause 2.23.

8

ISO 26000 Final Draft International Standard, Sub-clause 6.5.

5

The Global Reporting Initiative (GRI) has worked since 1997 to promote corporate social

responsibility and first issued its Sustainability Reporting Guidelines in 2000.

9

The current

version of the Guidelines, known as G3.1, was released inMarch 2011and establishes

“performance indicators” for companies to use in drafting reports evaluating their progress on

social responsibility. The “performance indicators” mirror the triple-bottom-line categories: G3.1

identifies “Social Performance Indicators” including labor practices, human rights, society, and

product responsibility; “Environmental Performance Indicators” including use of materials,

energy and water, impact on biodiversity, and emissions and waste; and “Economic Performance

Indicators,” including overall company revenue generation and company distribution to

stakeholders, local market impacts, and indirect economic impacts such as “infrastructure

investments and services primarily provided for public benefit.” The introduction to guidelines

version G3.1 defines sustainability reporting as “a broad term considered synonymous with

others used to describe reporting on economic, environmental, and social impacts (e.g., triple

bottom line, corporate responsibility reporting, etc.).”

10

The contemporary CSR movement’s version of CSR is not only reflected in ISO 26000

and G3.1, but is also now taught in business schools. A popular textbook for college business

ethics courses is Richard DeGeorge’s Business Ethics, now in its seventh edition. DeGeorge

describes the “changing business mandate” and then admonishes business students to recognize

that a new morality is now required. According to DeGeorge, “Business met the original

mandate of the American people to grow, produce a rich variety of goods at as low a price as

9

Global Reporting Initiative, “Sustainability Reporting Ten Years On,” Briefing Paper(October 2007),

http://www.globalreporting.org/NR/rdonlyres/430EBB4E-9AAD-4CA1-9478-FBE7862F5C23/0/Sustainability_Reporting_10years.pdf (accessed October 30, 2011).

10

Global Reporting Initiative, Sustainability Reporting Guidelines G3.1(2011): 3,

http://www.globalreporting.org/NR/rdonlyres/53984807-9E9B-4B9F-B5E8-77667F35CC83/0/G31GuidelinesinclTechnicalProtocolFinal.pdf (accessed October 30, 2011).

6

possible, provide employment, and help society achieve the good life.”

11

DeGeorge, however,

asserts that the original mandate no longer applies. According to DeGeorge, “The new moral

mandate to business can be found . . . in such movements as consumerism, environmentalism,

and conservationism . . . . What is clear in the new mandate is that business must now consider

the worker, consumer, and the general public aswell as the shareholder—and the views and

demands of all four—in making decisions.”

12

DeGeorge’s vision of the new morality is very

much one in line with the contemporary push for the triple-bottom-line standard.

Published works on the topic of CSR in recentyears also focus increasingly on the triple-bottom-line view of the socially responsiblecompany. For example, a recently-published

analysis of corporate social responsibility surveys the field of CSR and concludes that two

common themes run through contemporary discussions of CSR: “balancing the needs of

stakeholders and a company’s integration of economic considerations with environmental and

social imperatives.”

13

The definition of CSR is coalescing around the triple-bottom-line focus. Those who

attempt to define CSR in a more limited manner do soat the risk of irrelevance in the face of

increasing acceptance of the more comprehensive definition. Take, for example, the definition of

CSR adopted by Philip Kotler and Nancy Lee in their 2005 book entitled Corporate Social

Responsibility: Doing the Most Goodfor Your Company and Your Cause. Kotler and Lee assert

that “Corporate Social Responsibility is a commitment to improve community well-being

through discretionary business practices and contributions of corporate resources.”

14

In a similar

manner, The Economistsuggested in 2008 that “the simplesolution is thatbusinesses should

11

Richard T. DeGeorge, Business Ethics, Seventh Edition (Boston: Prentice Hall, 2010), 509.

12

DeGeorge, Business Ethics, 511.

13

Kerr, Janda, and Pitts, Corporate Social Responsibility: A Legal Analysis, 31-32.

14

Philip Kotler and Nancy Lee, Corporate Social Responsibility: Doing the Most Good for Your Company and Your

Cause(Hoboken, New Jersey: Wiley, 2005), 3.

7

concentrate on the sweet spot where initiatives are good for both profits and social welfare.”

15

Companies would fall far short of the expectations, however, under either ISO 26000 or G3.1 if

they were to follow this limited version of CSR.This is perhaps made most clear by reviewing

Kotler and Lee’s “best practices” recommendations, which urge companies to choose only a few

causes and choose causes that have synergy with products or potential tosupport business goals

such as cost reduction. This is clearly not the vision of ISO 26000 or G3.1, however, both of

which are much more comprehensive in scope: selecting only a small number of issues and

selecting issues which would also bring profit to the firm does not meet the terms of the

contemporary movement toward triple-bottom-line CSR.

Why the Shift to the More Radical “Triple-Bottom-Line” Version of CSR Now?

The movement toward the contemporary triple-bottom-line standard for corporate social

responsibility is driven by assertions of impending environmental catastrophe, failures of the

market system, and the introduction of new standards such as ISO 26000 and GRI’s G3.1. It is

further supported by arguments ranging from the alleged impotence of government at the hands

of multinational corporations to the supposed wide-ranging deregulation of business in the 1980s

and 90s. The unprecedented convergence of these conditions is then said to create a new era, for

which a new definition of the role ofbusiness in society is necessary.

Advocates of the new corporate social responsibility allege that the triple bottom line is

necessary due to threats to the very existence of human life on Earth posed by global warming,

deepening poverty, and population growth. John Elkington announces that the sustainability

crisis “is going to get a lot worse before we have any hope of turning the corner” and cites his

15

“The Next Question: Does CSR Work?,” The Economist, Special Report (January 18, 2008): 8-10.

8

long-standing concerns with population growth, pollution and ecosystem destruction.

16

According to Elkington, chief among the indicators of what he describes as the “environmental

precipice” are global warming, ozone depletion and the collapse of some ocean fisheries.

17

A

sense of environmental and human crisis pervades his book.

In this same vein, ISO 26000 clause 6.5.1.2 declares that “society is facing many

environmental challenges, including the depletion of natural resources, pollution, climate change,

destruction of habitats, loss of species, the collapse of whole ecosystems and the degradation of

urban and rural human settlements. As the world population grows and consumption increases,

these changes are increasing threats to human security and the health and well being of society.”

ISO 26000 goes on to call for reduction or elimination of “unsustainable volumes and patterns of

production and consumption and to ensure thatthe resource consumption per person becomes

sustainable.”

18

The introduction to the Global Reporting Initiative’s G3.1 Sustainability Reporting

Guidelines references this same theme. After noting that living conditions have improved for

many people around the world, the Guidelines describe “one of the most distressing dilemmas

for the 21

st

century” is the “alarming information about the state of the environment and the

continuing burden of poverty and hunger on millions of people.”

19

Impending catastrophe on

environmental and human levels is a common theme for adherents to the new CSR.

In addition to threats to life on planet Earth, advocates of the new CSR argue that the

corporate scandals of the Enron era coupled withthe more recent financial crisis point to

fundamental flaws with businesses and the markets in which they operate. Harvard Business

16

Elkington, Cannibals with Forks, 18-19.

17

Elkington, Cannibals with Forks, 20.

18

ISO 26000 Final Draft International Standard, 41.

19

Sustainability Reporting Guidelines, version G3.1, 2.

9

School professor Michael Porter, while offering his own version ofcorporate social

responsibility, opens a recent article with the stark recognition that “the capitalist system is under

siege.”

20

The scandals at companies such as Enron and Tyco were highly publicized and have

been portrayed by CSR advocates as just the latest in a long history ofcorporate abuses. The

financial crisis has largely been described in the media as a failureof banks and of the financial

markets. Of course, the definitive story of government responsibility for the financial crisis has

yet to be written. In its absence, blame has been focused on companies and markets. Again,

advocates of CSR have been ready to portray the latest crisis as characteristic of the workings of

the market.

21

The introduction of international standards such as ISO 26000 in November 2010 and

GRI’s G3.1 in March 2011 also provides a focal point for the triple-bottom-line version of CSR.

Over the past 20 years, one of the refrains in the CSR debate has been that CSR is undefined, and

therefore, organizations could shape their own definitions within the general contours of working

to meet social and environmental challenges in ways which would produce benefits for the

company.

22

That is no longer true. ISO 26000 and GRI’s G3.1 are comprehensive statements on

triple-bottom-line social and environmental issuesand companies will have a difficult task in

framing the issue now that these standards have been issued. Moreover, it is important to note

that in the case of both ISO 26000 and G3.1, non-compliance by companies will bring not only

the threat of criticism from non-governmental organizations, but also the possibility of

20

Michael E. Porter, “Creating Shared Value,” Harvard Business Review(Jan-Feb 2011): 64 and 77.

21

Ramon Mullerat, “Global Business and Human Rights—Overview,” in Global Business & Human Rights:

Jurisdictional Comparisons (The European Lawyer: 2011) ed. James Featherby,

http://www.europeanlawyer.co.uk/referencebooks_26_481.html (accessed October 5, 2011).

22

Michael Hopkins, “Criticism of the Corporate Social Responsibility Movement,” Chapter 31, in Corporate Social

Responsibility: The Corporate Governance of the 21

st

Century, ed. Ramon Mullerat (The Hague, Netherlands:

Kluwer Law International, 2005), 479-80.

10

termination of business relationships as companies which do comply must vouch for the social

responsibility of companies within their “sphere of influence.”

23

The move to transfer social and environmental responsibilities to business has also

received support from those who perceive dangers from globalization and those disappointed by

the failure of government, especially through alleged deregulation of business. The CSR

literature is replete with the assertion that multinational corporations are more powerful than

governments and that CSR is a means of taming this power. Of course, evidence of the power of

multinational corporations is generally not provided: The mere assertion seems sufficient among

CSR supporters. Rather than providing evidence, we read unsubstantiated assertions such as

“many TNCs wield more economic power than most nations”

24

and “many MNEs are larger and

more economically significant that the developing nations in which they operate.”

25

Joel Bakan

argues, “Today, corporations govern our lives. They determine what we eat, what we watch,

what we wear, where we work, and what we do.”

26

Little evidence of the alleged power of

multinationals, however, is provided in these discussions and what might be taken as evidence to

the contrary, such as Hugo Chavez’ nationalization of Exxon’s assets in Venezuela, are rarely

mentioned.

The failure of government—in the form of alleged wide-ranging deregulation of business

over the past 25 years—is another argument used to bolster acceptance of a new era of

expectations for business. Robert Reich argues that business has enjoyed greater influence in

American society in recent decades because “as measured by the number of final or proposed

23

See ISO Final Draft International Standard, sub-clauses 2.19 and 5.2.3.

24

Amy Sinden, “Power and Responsibility: Why Human Rights Should Address Corporate Environmental

Wrongs,” Chapter 17 in The New Corporate Accountability: Corporate Social Responsibility and the Law, Doreen

McBarnet, Aurora Voiculescu and Tom Campbell, eds. (Cambridge: Cambridge University Press, 2009), 515.

25

Kim Kercher, "Corporate Social Responsibility: Impact of Globalisation and International Business," Corporate

Governance eJournal(2007), 7 http://works.bepress.com/kim_kercher/1 (accessed October 30, 2011).

26

Joel Bakan, The Corporation: The Pathological Pursuit of Profit and Power(New York: Free Press, 2004), 5.

11

rules published in the Federal Register, regulation declined after 1980.”

27

Of course, the

continued publication of thousandsof final regulatory rules each and every yearsince 1980 does

not sound very much like deregulation, even though the annual promulgation of final rules did

peak in the ten year period between 1973 and 1983 in the period just after the creation of a

number of new federal administrative agencies, including the Environmental Protection Agency

and the Consumer Product Safety Commission. Businesses subject to U.S. environmental law,

antitrust law, consumer safety law, employmentlaw and labor union law might find it difficult to

imagine that they actually operate in an era of regulatory decline.

28

A final note on the push for a triple-bottom-line version of CSR is in order. In line with

the argument that a new CSR is mandated by the challenges of modern crises—in short, a new

model for a fundamentally different era—CSR proponents often deemphasize what is, in fact, a

long history of discussion of the topic of corporate social responsibility. While advocates

sometimes are willing to admit that the CSR movement has roots in social and environmental

activism of the last several decades, they often do not admit to any longer-standing debate. For

example, Branson states, “Roughly coinciding with Earth Day, in April 1970, were the

beginnings of a phenomenon that played out through the 1970s decade—the corporate social

responsibility movement.”

29

The debate over the roles and responsibilities of business in society,

however, can be traced back through the past two hundred years of American history. Examples

include the debate over monopoly powers granted tostate-chartered transportation companies in

the early 1800s, the controversy over the powerof “trusts” in the 1880s, and the focus on

27

Robert Reich, Supercapitalism(New York: Alfred A. Knopf, 2007), 140-42.

28

See the next section of this paper for a discussion regarding Reich’s ultimate rejection of CSR in favor of direct

government regulation.

29

See for example Robert Branson, “What is the ‘New’ Corporate Social Responsibility?: Corporate Social

Responsibility Redux,” 76 Tulane Law Review (2002): 1207, 1211.

12

managerial responsibility in publicly-traded companies in the 1930s.

30

The issue was also very

much in focus in the 1950s and early 1960s, as featured in prominent works by authors such as

Harold Bowen,

31

Theodore Levitt,

32

Keith Davis,

33

and Milton Friedman.

34

Discussion of the

role of business in society has been a recurring theme in American history.

The New Socialism?

The contemporary vision of CSR, with its requirement that companies show “returns” on

its economic, stakeholder and environmental bottom lines, is gaining more acceptance

worldwide. What is the nature of this concept? Will it lead to a new form of socialism?

As noted in the Oxford Handbook of Corporate Social Responsibility, “What is clear then

is that defining CSR is not just a technical exercise in describing what corporations do in society.

Definitional work in CSR is also a normative exercise in setting out what corporations should be

responsible for in society, or even an ideological exercise in describing how the political

economy of society should be organized to restrain corporate power.”

35

Even a cursory review of

the CSR literature leaves little doubt regarding the ideological underpinnings on the part of many

advocates for corporate social responsibility. Robert DeGeorge, in writing about what he

characterizes as the new moral mandate for business, highlights the fact that the new moral

mandate “embodies a view of business that, when taken as a whole, is clearly different from the

30

See, for example, the discussion on monopoly powers in early state-chartered companies in John W. Cadman, Jr.,

The Corporation in New Jersey: Business and Politics, 1791-1875(Cambridge, MA: Harvard University Press,

1949).

31

Harold Bowen, Social Responsibilities of the Businessman(New York: Harper, 1953).

32

Theodore Levitt, “The Dangers of Corporate Social Responsibility,” Harvard Business Review(September-October 1958): 41.

33

Keith Davis, “Can Business Affordto Ignore Social Responsibilities?,” California Management Review2 (Spring

1960): 70.

34

Milton Friedman, Capitalism and Freedom(Chicago: University of Chicago Press, 1962).

35

Andrew Crane et al., “The Corporate Social Responsibility Agenda,” Chapter 1 in The Oxford Handbook of

Corporate Social Responsibility, eds. et al. Andrew Crane (Oxford: Oxford University Press, 2008), 6, citing

Richard Marens, “Wobbling on a One-Legged Stool: The Decline of American Pluralism and the Academic

Treatment of Corporate Social Responsibility,” Journal of Academic Ethics2 (2004): 63-87.

13

view found in the writings of John Locke or in the U.S. Constitution.”

36

Sally Wheeler argues for

a new type of capitalism, asserting that “in stark terms it is no longer acceptable for [the

corporate] sector to assert that pursuit of profit is its sole legitimate aim in an epoch which looks

for both individuality and the collective interest to be addressed.”

37

Will CSR lead us to a new socialism? The Oxford Dictionary defines socialism as “a

political and economic theory of social organization that advocates thatthe means of production,

distribution, and exchange should be owned or regulated by the community as a whole.”

38

Two

distinct possibilities are presented which would take us down this path. First, redefining the

purpose of the business as serving the triple bottom line—creating independent obligations of the

company to stakeholders and the environment—would lead to social control of the company.

Second, implementation of CSR through greater regulation could certainly bring social control.

The Triple Bottom Line – Collective Decisions?

What is the relationship among the three “bottom lines?” Does management, with a view

to the long-term interests of shareholders, ultimately control the decision of the allocation of

scarce company resources? Or, does the business enterprise owe an independent obligation to

fulfill the stakeholder and environmental bottom lines, regardless of the impact on shareholders

and the long-term interests of the company? Asnoted above, advocates of the new CSR argue

that we have entered a new era of sustainable development that demands compliance with the

triple bottom line. In line with that view, especially in the case of publicly traded companies’

shareholders, the argument appears to be thatowners should receive no special status.

36

DeGeorge, Business Ethics, 511-12.

37

Sally Wheeler, Corporations and the Third Way(Oxford: Hart, 2002), 3.

38

Oxford Dictionary, http://english.oxforddictionaries.com/definition/socialism?region=us(accessed October 22,

2011).

14

Richard DeGeorge, who as noted above argues in favor of a “new moral mandate” for

business in his textbook Business Ethics, does not provide any particular explicit guidance

regarding the priorities of decision-making. He writes only that in the new mandate, “Sometimes

the demands of workers will carry greater weight than the interests of shareholders, sometimes

the opposite will be the case, and sometimes both will have to give way to environmental

needs.”

39

The implication is, however, that the shareholders—acting through company

management—do not have the freedom to override the interests or needs of stakeholders or the

environment.

ISO 26000 does not provide any assurance that the firm’s financial bottom line—

certainly a significant issue for its owners and for the very continued existence of the business—

has any particular importance. In fact, ISO 26000 focuses so intensely on the stakeholder and

environmental aspects of the triple bottom line that the “economic” bottom line has been almost

entirely ignored. Indeed, in the 86 pages of the ISO 26000 Final Draft International Standard, the

term “shareholder” never appears, and while the word owneris mentioned, it is mentioned only

in passing; and ISO 26000 does not describe the rights of owners of the firm or ascribe to them

any particular role. Likewise, the word investorappears only in one clause and even in that case

only to describe the possibility that a company might be pressured by investors to act in socially

responsible ways and that a company’s social responsibility performance might attract additional

investors. By comparison, it is interesting to note that the words environmentor environmental

occur well over 100 times in the document.

40

Moreover, the final text of ISO 26000 eliminatedthe only criteria in its section on

“Determining Significance,” which would have specifically recognized that firms could weigh

39

DeGeorge, Business Ethics, 511-12.

40

ISO 26000 Final Draft International Standard, Sub-clauses 3.2, 4.5 and 5.3.2.

15

the costs of taking action on principles of social responsibility identified by ISO 26000. Earlier

drafts of the ISO 26000 standard, up to and including the Draft International Standard text

released in June 2009, specificallyrecognized that firms could consider at least in part the

“potential effect of the related action compared to the resources required for implementation.”

41

The Final Draft International Standard, however, which became the official text of ISO 26000 in

December 2010, eliminated the phrase “compared to the resources required for implementation.”

The final wording of the clause states only that companies should consider the “potential effect

of taking action or failing totake action on the issue.”

42

ISO 26000 clearly promotes the triple

bottom line and does so in an expansive manner on the stakeholder and environmental “bottom

lines” but only narrowly for thatof the economic bottom line.

To the extent that the triple bottom line introduces independent obligations to

stakeholders and the environment, it not only introduces opportunities for management to exploit

its “many masters” to its own ends, but could besaid to usher in a new era of socialism as

companies now must respond to the control of the collective.

Expansion of Government Regulation and Ownership

The other possible path to socialism is through government moves tomandate the triple

bottom line by law and regulation, or even the possibility of complete government ownership or

control.

The likelihood of government regulation to “enforce” CSR is a common theme in the

CSR literature. In fact, some writers contend that efforts to achieve CSR on a voluntary basis are

futile and that immediate government regulation or government ownership would be the

appropriate course. Robert Reich calls for immediate regulation, asserting that in the absence of

41

International Organization for Standardization Working Group on Social Responsibility, ISO 26000 Draft

International Standard, Guidance on Social Responsibility, Sub-clause 7.3.1.2(Geneva, Switzerland: ISO, 2009).

42

ISO 26000 Draft International Standard, Sub-clause 7.3.2.2.

16

regulation, CSR is “as meaningful as cotton candy.”

43

Instead of voluntary CSR, Reich calls for

“laws and regulations that make our purchases and investments a socialchoice as well as a

personal one.”

44

Joel Bakan urges regulation as the principal means for ensuring that companies

“respect the interests of citizens,communities, and the environment.”

45

For these writers, CSR

must immediately become a matter of law and regulation.

For many scholars writing on the topic of CSR,a period for voluntary attempts at triple-bottom-line CSR is acceptable, but with the threat, and the expectation, that law and regulation

will soon be needed to enforce it. For example, in CSR: A Legal Analysis, the authors survey the

current landscape of largely voluntary CSR principles and concludethat law, which they also

describe as “coercive and adversarial measures,” will ultimately be necessary to enforce CSR.

46

Likewise, David Vogel argues that “virtue” must be replaced by government regulation:

“Consequently, the definition of corporate social responsibility needs to be redefined to include

the responsibilities of business to strengthen civil society andthe capacity of governments to

requirethat all firms act more responsibly.”

47

DeGeorge concludes his discussion of the new

moral mandate with a warning that if companies do not voluntarily respond to the demands of

the new morality, the result could be governmental management of corporations, or even

government ownership.

48

Voluntary triple-bottom-line principles are not likely to be the end of

the story.

Beyond government regulation, another question is whether government control of

business is really beyond contemplation in thisdiscussion. Two important points need to be

43

Reich, Supercapitalism, 171.

44

Reich, Supercapitalism, 127.

45

Bakan, The Corporation, 161.

46

CSR: A Legal Analysis, 602-04.

47

David Vogel, The Market for Virtue: The Potential and Limits of Corporate Social Responsibility(Washington,

D.C.: Brookings Institution, 2005), 172 (italics in original, underlining added for emphasis).

48

DeGeorge, Business Ethics, 512.

17

emphasized here. Depending on how the “triple bottom line” is enforced through law and

regulation, one possibility is that the owners ofbusiness enterprises could see control of the

enterprise pass to the state. Second, the CSR literature also advocates the concept of mandating a

“public purpose” for any entity that seeks registration with the government, which would include

corporations, limited liability companies, limited partnerships, and limited liability companies.

One version of this concept would call for government powers to revoke state registration if, in

fact, the public purpose is not met.

49

This could provide a very direct method of government

control over businesses. In fact, Maryland, Virginia, New Jersey, Vermont and Hawaii have

already enacted laws to allow a business to voluntarily register a public purpose for the

company.

50

Is the next step to impose a public purpose requirement on all businesses?

Conclusion: In Defense of the Traditional View of the Role of Business in Society

By 2005, at least with respectto some version of CSR, The Economistcould report that

“intellectually, at least, the corporate world has surrendered and gone over to the other side,”

51

citing indicia such as the issuance of Corporate Social Responsibility or Corporate Citizenship

reports, appointment of CSR management officials, executives speeches referencing CSR, and

the emergence of a consulting industry to advise companies on CSR. Those trends certainly have

not been reversed over the past six years if we sample just one of those measures—statements by

company executives on CSR:

• Duke Energy Chairman and CEO, Jim Rogers: “Sustainability—operating our business in

a way that is good for people, the planet and profits—is, in my opinion, no longer

49

CSR: A Legal Analysis, 595.

50

Bills have been introduced to enact such laws in Colorado, Pennsylvania, New York, Michigan and North

Carolina. See “B Corporation: A New Type of Corporation for a New Economy,”

http://www.bcorporation.net/publicpolicy (accessed on November 1, 2011).

51

“The Good Company,” The Economist, Special Report (January 22, 2005): 3.

18

optional. It is the strategic and decision-making approach we are following at Duke

Energy to create long-term value.”

52

(pg. 4)

• Coca-Cola Company Chairman and CEO, Muhtar Kent: “In the midst of the global

financial downturn, the economic, environmental and social implications of business are

more important than ever. There’s no question that the world is undergoing a massive

resetting of priorities, values and expectations.”

53

• Nike CEO, Mark Parker: “We saw that doing the right thing was good for business

today—and would be an engine for our growth in the near future. With each new

discovery and partnership, we willingly gave up old ideas to shift our thinking toward a

better, smarter, faster and ultimately more sustainable future—financially,

environmentally and socially.”

54

Certainly companies seem to have accepted some version of CSR, but the question remains

whether companies understand the implications of CSR raised above, both with respect to

current issues surrounding the triple bottom line aswell as the prospect for future enforcement

through additional law and regulation.

Businesses need to speak out in defense of private enterprise and markets. The debate

over CSR is taking place largely without the participation of companies, especially at what may

be a crucial turning point as the more radical version of CSR is moving toward broader

acceptance. Companies may choose not to speak out for a variety of reasons, including:

52

Duke Energy, 2008-2009 Sustainability Report, 4, http://www.duke-energy.com/pdfs/sar09-01-complete-report-rev.pdf (accessed October 26, 2011).

53

Coca-Cola Company, 2008-2009 Sustainability Review, 2, http://www.thecoca-colacompany.com/citizenship/pdf/2008-2009_sustainability_review.pdf (accessed October 26, 2011).

54

Nike, Inc., Nike, Inc. Corporate Social Responsibility Report, 2007-2009, 4,

http://www.nikebiz.com/crreport/content/about/2-1-0-ceo-letter.php (accessed October 26, 2011).

19

• Business has been put on the defensive as the result of corporate scandals and the

financial crisis;

• Business finds it difficult to articulate the inherent “responsibility” of firms and markets

on the one hand, and explain why they should not follow the CSR brand of

“responsibility” on the other;

• Taking a higher profile on CSR issues might bring unwanted attention from NGO’s;

• Smaller-and medium-sized companies may nothave as many resources to devote to

speaking out on CSR issues; and

• Crony capitalism—the largest companies may see a competitive advantage to “investing”

in CSR knowing that their smaller competitors cannot.

Whatever the reason, business shouldspeak out on the issue of CSR, especially at this important

time. Todd Stitzer asserts that “by being too quiet in the past, business has allowed the argument

to pass by default, with very damaging perceptions forming along the way.”

55

The message that

companies must communicate is that CSR is taking us down the wrong path and that issues

relating to poverty, a growing world population, and the environment are far more likely to be

successfully addressed through the traditional view of the role of business in society coupled

with effective government, a vibrant civil society, and anactive citizenry.

55

Todd Stitzer, “Business Must Loudly Proclaim What it Stands For,” The Financial Times, online edition, May 31,

2006.

Morgan Stanley's shares rose in premarket trading.

Morgan Stanley's shares rose in premarket trading.  Garbage? To David Steiner, it's "all good."

Garbage? To David Steiner, it's "all good." Major

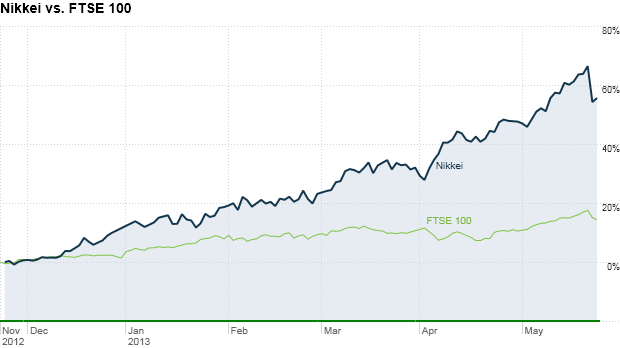

European indexes, including London's FTSE 100, have made significant

gains over the past few months but have not pushed nearly as high as

Japan's Nikkei or U.S. benchmarks.

Major

European indexes, including London's FTSE 100, have made significant

gains over the past few months but have not pushed nearly as high as

Japan's Nikkei or U.S. benchmarks.